Long Angle survey reveals how high-net-worth households evaluate and spend on financial, home, and professional services

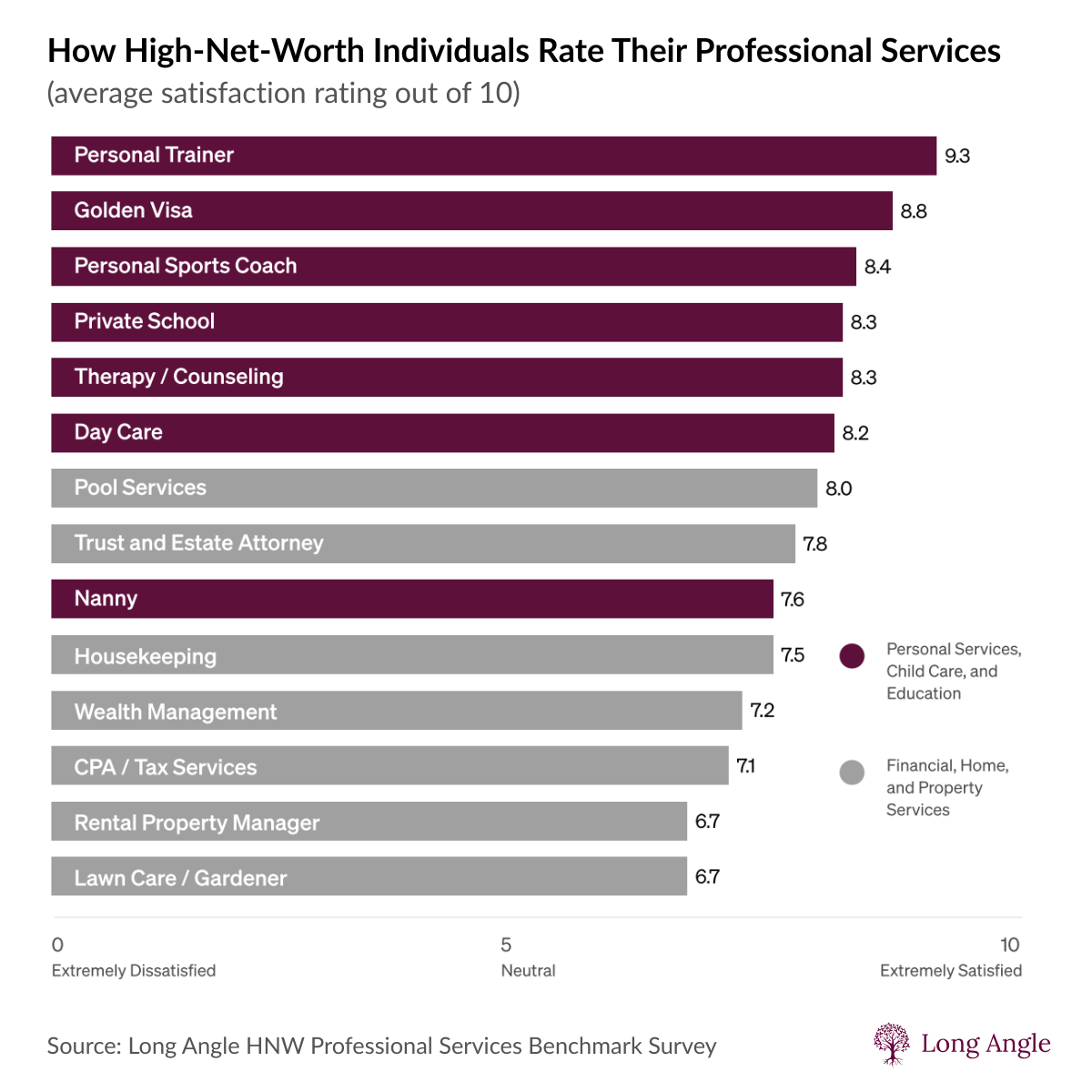

Four in ten high-net-worth clients may switch CPAs, half lack an estate attorney, and personal trainers rank highest in satisfaction

DALLAS, Oct. 24, 2025 (GLOBE NEWSWIRE) -- According to new research from Long Angle, a private community of 6,000+ very high-net-worth individuals, wealthy households are rethinking how they allocate time, money, and trust across professional services.

The 2025 High-Net-Worth Professional Services Benchmark Study offers a detailed look at how affluent families employ professional services spanning financial, family, and lifestyle domains. While CPAs and housekeepers remain core partners, the study finds growing engagement and satisfaction with services that focus on health and family outcomes.

Key Findings

-

CPA loyalty is at risk. While 82% of respondents rely on a CPA or tax professional, four in ten are considering switching providers, citing growing expectations around responsiveness and proactive guidance.

-

Estate planning remains underutilized. Just over half of high-net-worth households have a trust and estate attorney, with usage rising alongside wealth complexity.

-

Wealth manager adoption is selective. Only one-third of respondents use a wealth manager, reflecting a more hands-on approach to portfolio management among younger, investment-savvy households.

-

Services focused on personal or children’s well-being deliver the greatest satisfaction. Personal trainers and private schools earn some of the highest satisfaction ratings, while financial and home services, though more widely used, lag in satisfaction.

-

Younger households prioritize emotional wellness. Forty-three percent of respondents under 40 attend therapy or counseling—the highest participation rate across age groups.

-

Expectations for service quality are rising. Communication, accessibility, and measurable value are the leading factors shaping satisfaction across categories.

- Spending reflects life priorities. The highest annual costs concentrate in child care and education (e.g., nannies at roughly $50K per child per year), followed by a second cost tier including wealth and property management.

“There’s a clear divide in how high-net-worth households feel about the services they use,” said Chris Bendtsen, Market Intelligence Lead at Long Angle and author of the report. “They derive the greatest satisfaction from services that directly improve their lives or their children’s well-being. At the same time, they’re reevaluating providers that lack a personal or emotional connection, particularly financial and home services that often feel more transactional.”

“This study mirrors what we see qualitatively as members,” added Tad Fallows, Co-Founder and Managing Director at Long Angle. “Successful entrepreneurs and executives are willing to pay significant amounts for services that deliver significant time leverage or demand specific expertise, like attorneys. The current generation is much more selective, however, in paying for services they don’t believe require technical expertise and where outsourcing is expensive. Limited adoption of wealth management is the most clear example.”

The study draws on proprietary Long Angle survey data and qualitative insights from verified high-net-worth individuals, examining more than 20 professional service categories across four domains: financial, home and property, personal and family, and child care and education.

Access the full report: https://www.longangle.com/research/high-net-worth-professional-services

About Long Angle

Long Angle is a vetted community of high-net-worth individuals navigating complex financial and personal decisions. Members collaborate through peer advisory groups, benchmark studies, and curated investment access, collectively investing more than $100 million annually across private markets.

Founded on the principles of peer-driven learning and trusted confidentiality, Long Angle helps successful wealth builders optimize their portfolios, families, and purpose through evidence-based insights and shared experience.

Learn more: www.longangle.com

Media Contact:

Chris Bendtsen

Market Intelligence Lead, Long Angle

chris.bendtsen@longangle.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.